Media Release

Mangaluru, Jul 24: To explore new horizons in banking and gather ideas for the next phase of growth, MCC Bank organized the Idea Summit 2025 at Hotel Avatar, Attavar, Mangaluru on July 23.

The summit was presided over by Sahakara Ratna Anil Lobo, chairman of MCC Bank. Distinguished speakers included Michael D’Souza, renowned NRI entrepreneur and philanthropist; Prof Dr Aloysius Sequeira, retired professor (HAG), NITK Surathkal; CA Maxim M Fernandes, partner, RMCR & Co, Mangaluru; Prof CA Lionel Aranha, chartered accountant, arbitrator, and visiting professor, IIM Kozhikode; and Allen C Pereira, veteran banker and former chairman & managing director of Bank of Maharashtra.

The summit commenced with a prayer song performed by bank staff members Alwyn and his team.

A presentation highlighting MCC Bank’s remarkable growth over the past seven years and up to 105 years was shared with the gathering.

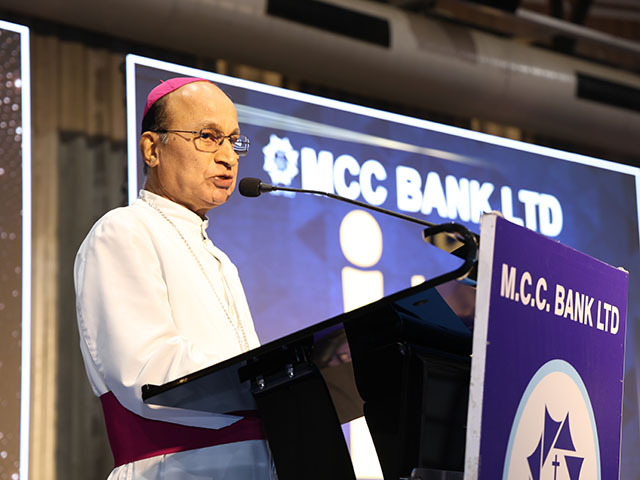

The summit was inaugurated by Dr Peter Paul Saldanha, bishop of Mangalore, and Dr Gerald Isaac Lobo, bishop of Udupi along with dignitaries present on the dais.

In his opening address, Bishop Dr Gerald Isaac Lobo recalled the bank’s 113-year journey since its inception and commended the current management for doubling the business achieved over the first 105 years in just seven years, as highlighted in the presentation. He further stated that the momentum gained over the past seven years should continue, and expressed his hope that the bank will achieve 100% growth in the next decade.

“The bank needs to remember and thank God for the hardships, sacrifices, and achievements of the past 105 years; review the progress and changes made over the last seven years; and look forward with hope and determination to the next ten years in order to achieve its mission,” he said. While emphasizing the importance of preparing for greater achievements in the coming decade, he urged the bank to reflect on its vision and mission and to take appropriate steps for further development.

He expressed his happiness and also wondered to note that the bank has already embraced transparency and accountability, as demonstrated in the presentation and it bears a greater social responsibility toward the community. He emphasized the need for the bank to adapt to emerging technologies, particularly AI, and encouraged it to adopt a futuristic approach through this summit. He concluded with a prayer for the summit’s success.

Bishop of Mangalore, Dr Peter Paul Saldanha praised the tremendous achievements of the management of the bank for the last 7 years and urged for continuance of quality service with a smile, which will surely attract more and more customers to the bank. While he lauded the bank for its uniqueness, he called upon the bank to ensure interaction in the preferred and heart touching language of the customer. He thanked the speakers for their inputs and insights and called upon the bank to reflect and review the suggestions to encourage banking to the students, youth empowerment through MSME loans. It is not enough to have corporate look to the bank; but, the staff members should also be competitive enough to face the challenges of banking and they should go to each and every house and villages in their vicinity to introduce the bank to every nuke and corner of region. He also urged the bank to help for the growth of all communities in the region.

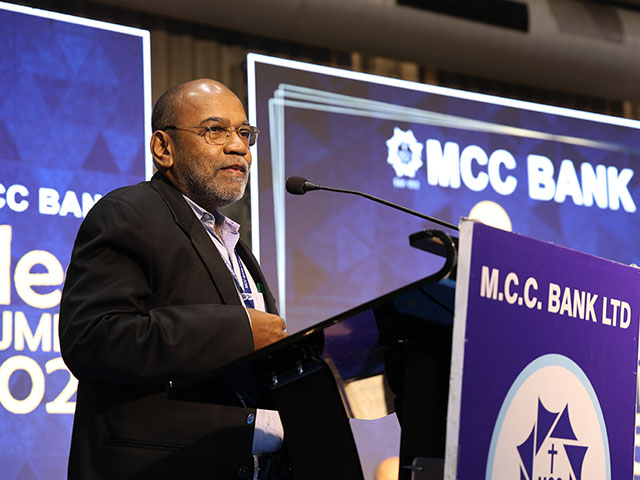

Delivering the keynote address, Michael D’Souza shared his perspective on the bank’s future. He underlined the importance of the summit in gathering inputs to help realize the bank’s long-term vision. He expressed gratitude to both the bishops for their presence, noting it as a sign of their support and commitment to MCC Bank. He praised the chairman and the board of directors for their integrity and perseverance during challenging times. He stressed the importance of delivering quality customer service, increasing deposits, maintaining quality in lending, strengthening the recovery process, and upgrading and expanding branch operations. He emphasised the need for customer reach at all levels to create confidence. He also encouraged the bank to explore business collaborations in areas such as insurance and mutual funds and called on the participants of the Summit to become brand ambassadors for the bank.

In his presidential address, chairman Sahakara Ratna Anil Lobo expressed heartfelt gratitude to all the dignitaries for their valuable insights and suggestions. He noted that since taking charge, the current management has successfully implemented its vision, overcome the challenges and reached its envisaged goals. He highlighted the bank’s achievements under the current leadership and its success in turning challenges into opportunities. He thanked all participants for their presence and contributions in making the summit a grand success.

Prof Dr Aloysius Sequeira reflected on the progress made during previous workshops, especially for formulating the bank’s vision, mission, and core values. He encouraged the bank to aim high and stay committed to these guiding principles to ensure sustainable growth over the next 10 years.

CA Maxim M Fernandes, in his address, highlighted the advantages of being an urban co-operative bank: community-focused banking, ease of access, personalized service, membership-based profit sharing, support for local development, and dual control by both the regulators, i.e. RBI and the co-operative department. He lauded the bank for its professional image and effective NPA management over the last seven years. He also stressed the need to support young entrepreneurs, particularly in the MSME sector, and called for collective efforts for the betterment of the bank.

Prof CA Lionel Aranha encouraged the bank to take initiatives to open accounts for all community members and to adapt to changing trends to foster community development. He advised exploring new revenue streams such as insurance services, Demat accounts, contract farming, reverse mortgages, credit/debit card promotions and Utility payment partnerships (e.g. tie-up with Mangalore City Corporation for cashback offers). He also emphasized the need for well-defined growth strategies. He proposed to classify services of MCC Bank into consumer & commercial banking (vehicles, mortgages, business loans) and retail banking (education, gold loans). He called upon the management to ensure that staff are fully knowledgeable about the bank’s products and emphasized that much more can be done to elevate the bank.

Allen C Pereira highlighted the importance of mastering technology as a tool for progress. He advised the bank to recognize the potential of ordinary people and to engage with students and youth as future stakeholders in the nation’s development.

Esteemed customers such as Fr Faustine Lobo, director of Father Muller's Medical College Hospital, Dr Vincent Alva, Pius L Rodrigues and Alwyn Crasta shared their valuable suggestions to help the bank grow further and assured their continued support for its progress.

The vice chairman, board of directors, general manager, deputy general manager, senior manager, branch managers, officers of the bank, heads of institutions, and top depositors were present at the summit.

The event was compered by Floyd D’Mello.