Media Release

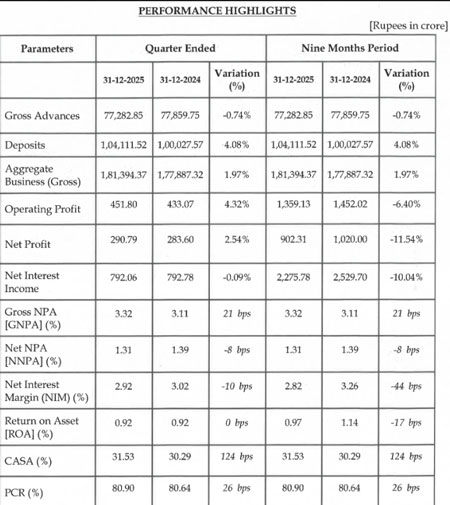

Mangaluru, Feb 10: Karnataka Bank recorded a steady progress in aggregate business, which stood at Rs 1,81,394.37 cr as on December 31, 2025, compared to Rs 1,76,461.34 cr as on September 30, 2025, registering a 3% QoQ increase.

In the meeting of the board of directors held on February 10 at Mangaluru, the board approved the financial results for the quarter and nine months period ended December 31, 2025.

Bank’s gross advances stood at Rs 77,282.85 cr registering QoQ growth of 4.9% and aggregate deposits stood at Rs 1,04,111.52 crores registering QoQ growth of 1.3%. For Q3 FY26, the Bank recorded a net profit of Rs 290.79 cr, compared to Rs 283.60 cr in the corresponding quarter of the previous year and Rs 319.12 cr as on Q2 FY26.

Asset quality improved during the quarter, with GNPA declining to 3.32% as on December 31, 2025, compared to 3.33% as on September 30, 2025. Similarly, NNPA improved to 1.31% from 1.35% over the same period. The Provision Coverage Ratio (PCR) (excluding TWO) increased to 61.23% as on December 31, 2025, from 60.22% as on September 30, 2025.

The bank's capital adequacy ratio stood at 19.94% compared to 20.84% as of September 2025.

In line with RBI’s revised draft guidelines on Liquidity Coverage Ratio (LCR), the Bank has computed the same as on December 31, 2025, which stands at 186.84%.

Announcing the results for Q3 FY26 at the bank’s head office at Mangaluru, Raghavendra S Bhat, managing director & CEO, said, “During the quarter, the Bank recorded QoQ growth of 5% in advances and showed an improvement in asset quality. We reiterate that our focus on the RAM (Retail, Agri, and MSME) segments, and pursuing a strong base in low-cost deposits has started accruing benefits to the Bank.

As the bank has already energised the distribution ecosystem with building rigours into the processes, the accretion of a high-quality credit portfolio, is now being visible. In parallel, digital transformation initiatives are gaining traction, with the development of new products and platforms to enhance customer experience and improve operational efficiency.

Further, various analytical tools have now been embedded into the core business processes, enabling analytics-driven decision-making and supporting predictive and strategic use cases to drive efficiency and deeper insights across the Bank.

Our mission and vision remain firmly anchored as we advance our objectives with renewed clarity and momentum”.