Trading calculators have become essential tools for beginners and experienced traders who want to make informed decisions based on accurate numbers rather than emotional impulses. They help traders determine position sizes, evaluate potential profits, assess risks, and manage their capital effectively across various financial markets.

In the competitive world of finances, having access to the best trading calculators from WR Trading can significantly improve your performance and help you develop a more systematic approach to market analysis. These specialized tools eliminate the guesswork from critical decisions and provide instant calculations that would otherwise require complex mathematical formulas and considerable time to compute manually.

These tools can be easily incorporated into the user interfaces of modern trading platforms, which can enable traders to confidently make quick judgments in ever-changing market situations. Traders can now employ complex tactics that were previously available to professionals, thanks to the democratization of trading techniques brought about by the shift from manual calculations to automated instruments. The way traders manage their risks and position sizing has been drastically altered by these technological advancements.

Key Benefits of the Tools

- Precise position sizing ensures that each trade aligns with predetermined financial liability parameters.

- Instant profit and loss calculations help traders evaluate opportunities before entering positions.

- Risk-reward analysis enables objective trade selection based on mathematical probabilities.

- Consistent money management maintains discipline across all market conditions.

- Time efficiency eliminates manual calculations and reduces decision-making delays.

- Error reduction minimizes costly mistakes from mental arithmetic or emotional decisions.

- Performance tracking provides data-driven insights into your strategy’s effectiveness.

- Strategy optimization helps identify areas for improvement in trading approaches.

1. Day Trading Calculator

This tool helps traders determine potential profits and losses for intraday trading strategies. This comprehensive tool takes into account risk per trade, risk-reward ratios, and hit rates.

Using this tool involves entering your Risk per Trade (in USD), the risk-reward ratio, hit rate and the number of trades you want to execute. It instantly displays your potential profit, maximum loss, and PNL.

The tool particularly benefits scalpers and momentum traders who need to make quick decisions based on precise calculations. It eliminates the time-consuming process of manual computation and reduces the likelihood of position sizing errors that could lead to excessive losses or missed profit opportunities.

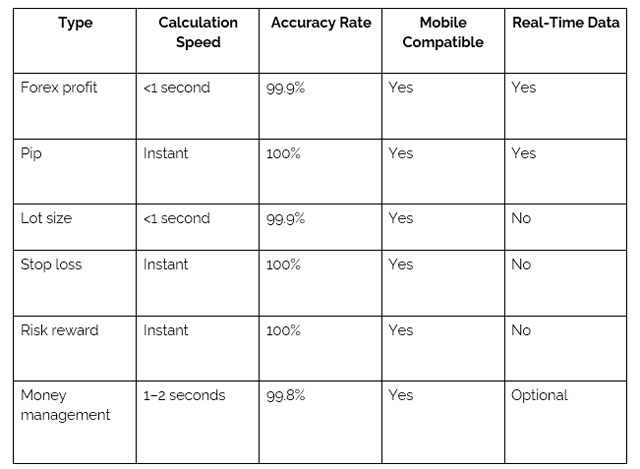

2. Forex Profit Calculator

This tool specializes in currency pair trading and takes into account the currency pair you want to trade in, whether your trade will be long or short, as well as your entry and closing prices.

This helps forex traders understand exactly how much they stand to gain or lose based on specific pip movements in their chosen currency pairs. It supports the majority of major and minor currency pairs.

Traders use this tool before entering positions to evaluate if potential profits justify the financial liability involved. It allows you to compare different currency pairs to identify the most profitable opportunities based on expected pip movements and current market volatility.

3. Win Rate Calculator

The Win Rate calculator provides crucial insights into your trading performance by analyzing the percentage of your winning trades in comparison to the overall number of your executed trades. Seeing the number will help you identify if your strategy has a positive expectancy.

Professional traders use this tool to evaluate strategy effectiveness and make necessary adjustments to their approach. It helps determine if you need to improve your win rate, increase your average profit per trade, or reduce your average loss to achieve consistent profitability. It also assists in setting realistic performance goals and tracking progress toward those objectives.

Additional Components for Win Rate Analysis

To properly evaluate your winning rate, you may want to turn to these components of the analysis:

- Average winning trade size determines the profit potential of successful positions.

- Average losing trade size reveals your exposure and loss management effectiveness.

- Risk-reward ratio shows the relationship between potential gains and losses.

- Breakeven win rate indicates the minimum success rate needed for profitability.

- Actual versus expected performance highlights strategy effectiveness.

- Time period analysis reveals consistency across different market conditions.

- Market correlation identifies whether success rates vary by instrument.

Access it at: https://wrtrading.com/tools/calculators/win-rate/

Regularly monitoring your win rate alongside other performance metrics will allow you to identify patterns in your trading behavior and make data-driven improvements. This tool proves particularly valuable during strategy development and backtesting phases and can help traders understand the statistical edge of their systems.

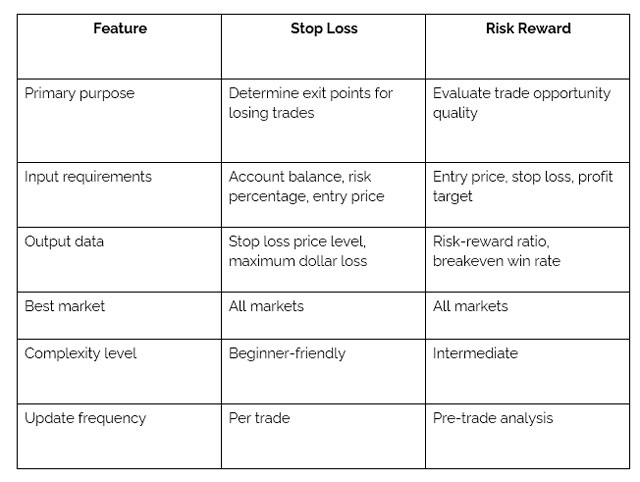

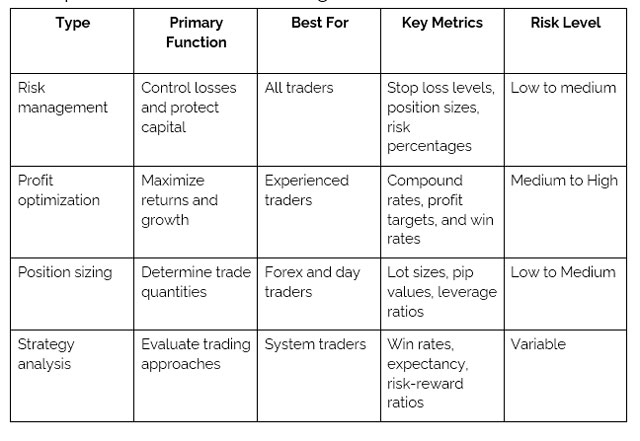

4. Stop Loss Calculator

The Stop Loss calculator determines optimal stop-loss placement based on your risk tolerance and position size. This critical financial liability management tool helps traders protect their capital by calculating exact stop-loss levels that align with their predetermined liability parameters.

It considers factors such as the currency of your trading asset, the unit of your position size, your account’s currency, your entry price, and a number of other factors. This data allows it to precisely calculate what Stop Loss and Take Profit levels to set when you place a trade.

It prevents emotional decision-making when determining exit points for losing trades. It provides mathematical precision in stop-loss placement and ensures that no single trade can cause catastrophic damage to your account.

Risk Management Calculator Comparison

5. Risk Reward Calculator

This tool analyzes potential trades by comparing possible profits against potential losses. This helps traders determine if a trade opportunity offers favorable odds before committing capital. It calculates risk-reward ratios instantly and shows if your profit targets justify the liabilities you're taking based on your stop-loss placement and entry point.

Professional traders use this calculator to filter out low-probability trades and focus on opportunities with asymmetric risk-reward profiles. It helps maintain discipline by providing objective criteria for trade selection rather than relying on gut feelings or market emotions.

Understanding and consistently applying favorable risk-reward ratios represents one of the most important aspects of successful trading. This makes it easy to maintain minimum acceptable ratios across all trades and contributes to positive expectancy over large sample sizes of trades.

6. Pip Calculator

The Pip Calculator converts pip movements into monetary values for various currency pairs and position sizes. This eliminates confusion around pip values, which vary depending on the currency pair, lot size, and account denomination.

Traders rely on this tool for quick position sizing decisions and profit target setting in forex markets. It helps them understand the actual dollar impact of pip movements, which makes it easier to assess if potential trades align with your risk management guidelines.

The tool also helps compare opportunities across different currency pairs by standardizing pip values in your account currency. This enables more informed decision-making when choosing between multiple trading opportunities with different pip values and volatility characteristics.

7. Money Management Calculator

The Money Management calculator helps traders implement systematic capital allocation strategies across their portfolios. This tool incorporates various money management methodologies, and the risk of the money management you are willing to take (in %).

Access it at: https://wrtrading.com/tools/calculators/money-management/

Traders can use this tool to balance aggressive growth strategies with capital preservation requirements. This allows them to trade without risking their overall financial well-being.

Critical Money Management Principles

Effective money management relies on several fundamental principles that guide position sizing and capital allocation decisions:

- Fixed fractional sizing limits each trade to a predetermined percentage of account equity.

- Kelly criterion application optimizes position sizes based on edge and probability.

- Diversification requirements spread liability across multiple instruments and strategies.

- Drawdown management reduces position sizes during losing streaks.

- Profit reinvestment rules determine when and how to increase position sizes.

- Capital preservation thresholds establish minimum account levels for trading continuation.

- Risk parity allocation balances hazard contribution across different positions.

- Volatility-based adjustments modify position sizes based on market conditions.

- Maximum exposure limits cap total portfolio risk at any given time.

Implementing proper money management represents the difference between amateur and professional trading approaches. These ensure that position sizing decisions align with mathematical principles rather than emotional impulses, which contributes to more consistent long-term results.

8. Martingale Calculator

This calculator evaluates the financial liability and capital requirements of martingale betting strategies in trading contexts. It calculates the exponential increase in position sizes required to recover from consecutive losses using martingale approaches.

While martingale strategies remain controversial in trading circles, this calculator helps traders understand the mathematical realities of such approaches. It demonstrates the capital requirements for sustaining the sequences through extended losing streaks and calculates the probability of account ruin based on win rates and starting capital. The tool serves as a planning resource for those who consider martingale strategies and an educational tool that highlights the risks involved.

9. Lot Size Calculator

This tool determines the exact number of lots to trade based on your risk parameters and stop-loss distance in pips. This essential tool ensures your position sizes align perfectly with your finance management rules, regardless of the currency pair or stop-loss placement.

Access it at: https://wrtrading.com/tools/calculators/lot-size/

Professional forex traders depend on this calculator to maintain consistent risk across all trades, regardless of stop-loss distances or currency pair volatility. It eliminates the complex mental math required for proper position sizing and reduces the likelihood of errors that could lead to excessive losses. This proves particularly valuable when trading multiple pairs simultaneously or managing positions across different account currencies.

The tool also helps traders scale their positions appropriately as their account grows or contracts, which ensures that risk percentages remain constant regardless of account size changes. This systematic approach to position sizing contributes to more predictable outcomes and smoother equity curves.

Forex-Specific Calculator Performance Metrics

10. Compounding Calculator

The Compounding calculator projects potential account growth based on consistent trading performance and reinvestment strategies. This planning tool shows how small, consistent gains can lead to exponential growth over time through the power of compounding. It factors in variables such as starting capital, average return per period (in %), and time horizon.

Successful traders use this tool to visualize the time required to achieve specific financial targets. It helps them evaluate different strategies by comparing their compounding potential over extended periods. It also helps them determine optimal reinvestment rates that balance growth objectives with income requirements.

11. Binary Options Calculator

Considering the all-or-nothing nature of binary options, this calculator evaluates potential outcomes for trades. It takes into account the Investment Amount Per Trade (in USD), Binary Options Profit by the broker, and the number of winning and losing trades, and calculates how much you can profit and lose on a trade.

Access it at: https://wrtrading.com/tools/calculators/binary-options/

Despite the simplicity of binary options trading, proper mathematical analysis remains crucial for success. This tool provides the analytical framework necessary for treating binary options as a serious trading endeavor.

12. Binary Options Compounding Calculator

The Binary Options Compounding calculator specifically addresses the unique compounding dynamics of binary options trading. It accounts for the fixed payout nature of binary options when projecting account growth through reinvestment strategies.

Access it at: https://wrtrading.com/tools/calculators/binary-options-compounding/

Professional binary options traders utilize this calculator to develop systematic growth strategies that leverage compounding while managing downside risks. It helps determine sustainable growth rates based on realistic win rate assumptions and available capital.

This specialized tool proves invaluable for binary options traders seeking to transform small accounts into substantial trading capital through disciplined compounding approaches. It provides the mathematical framework for achieving consistent growth while avoiding the account-devastating losses that plague many binary options traders.

Comparison of Calculator Categories

To Sum up

These 12 calculators from WR Trading represent essential tools for modern traders who seek to approach markets with mathematical precision and disciplined risk management. Each of them addresses specific aspects of trading, from basic position sizing to complex compounding strategies, and provides traders with the analytical capabilities necessary for long-term success.

The true strength of these tools is found in the way they can be combined to form a complete trading strategy. When applied regularly, they create a framework for making decisions that eliminates the mental strains that frequently result in bad trading decisions. Professional traders understand that repeatable procedures, not chance, are the key to long-term success, and these offer the framework for creating such procedures.

Incorporating these tools into your routine will allow you to eliminate guesswork and reduce emotional decision-making. It will also help you implement systematic approaches that professional traders use to achieve consistent profitability.

The comprehensive suite of tools covers every major aspect of mathematics, whether you focus on forex, stocks, binary options, or strategies. Regular use of these tools helps develop the disciplined mindset required for successful trading, while ensuring that every trade aligns with your risk management rules and long-term objectives.

As markets continue to evolve and become more competitive, traders who leverage calculating technologies gain a significant edge over those who rely on intuition or emotional decision-making alone. This integration transforms reactive behaviors into proactive, data-driven strategies that consistently outperform random market approaches over extended time periods.