Daijiworld Media Network – Sydney

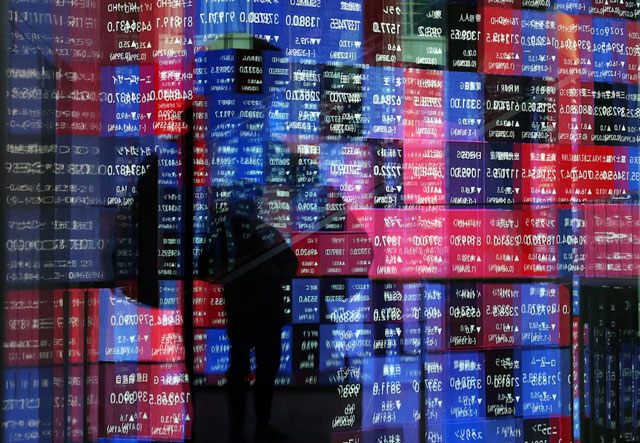

Sydney, Ded 22: Asian share markets opened the week on a firm note on Monday, tracking strong tech-led gains on Wall Street, even as the Japanese yen slid to record lows against the euro and Swiss franc despite higher interest rates at home.

Trading volumes remained thin in a holiday-shortened week across many global markets, but sentiment stayed positive ahead of delayed US economic data expected to show robust growth in the third quarter. Median forecasts suggest the US economy expanded at an annualised pace of 3.2 per cent, helped by a sharp fall in imports after a surge earlier this year ahead of new tariffs.

However, analysts sounded a note of caution. Bank of America flagged that its investor sentiment indicator has moved into “extreme bullish” territory, often a signal of an impending market pullback. The firm noted that readings above 8.0 have historically preceded declines, with global equities falling a median 2.7 per cent over the following two months.

Despite the warnings, optimism prevailed, with S&P 500 futures gaining 0.2 per cent and Nasdaq futures rising 0.3 per cent.

Japan’s Nikkei climbed 1.5 per cent, extending its rebound as the sharply weaker yen boosted expectations of stronger export earnings for Japanese companies. The yen’s slide followed the Bank of Japan’s decision to raise interest rates to a 30-year high of 0.75 per cent, which also triggered heavy selling in government bonds. Minutes of the BOJ meeting are due on Wednesday, while the central bank governor is scheduled to address a business lobby on Christmas Day.

The yen touched fresh record lows at 184.90 against the euro and 198.08 against the Swiss franc. The dollar traded at 157.67 yen, with investors wary of breaching the November peak of 157.90 amid fears of possible intervention by Japanese authorities. Japan’s top currency official warned against one-sided moves and signalled readiness to act against excessive weakness.

Elsewhere in Asia, MSCI’s broad Asia-Pacific index excluding Japan rose 0.3 per cent, while South Korea’s market surged 1.8 per cent on optimism over artificial intelligence-linked earnings.

Analysts at TD Securities said global equity funds recorded their highest weekly inflows on record at $98 billion last week, led by US equities. Chinese equity funds posted their third-largest weekly inflow of 2025, while emerging markets saw their biggest inflows since April. Bond fund inflows, however, slowed for the fourth consecutive week.

In commodities, silver continued its remarkable rally, hitting a fresh record of $67.48 per ounce and taking its gains this year to nearly 134 per cent. Gold rose 0.6 per cent to $4,362 an ounce. Oil prices also moved higher after the US intercepted a Venezuelan oil tanker over the weekend, with Brent crude up 0.7 per cent at $60.88 a barrel and US crude rising to $56.89 per barrel.