Daijiworld Media Network – New Delhi

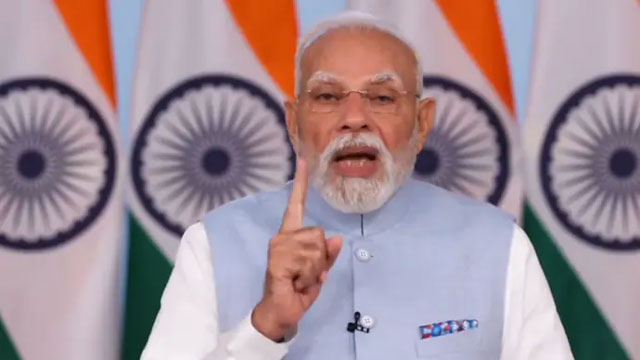

New Delhi, Sept 21: Prime Minister Narendra Modi, addressing the nation on the eve of Navaratri, unveiled a sweeping overhaul of India’s indirect tax regime, declaring the launch of GST 2.0 as the beginning of a “Bachat Utsav” — a nationwide festival of savings aimed at reducing household burdens and energising the economy.

Modi said the reforms would not only ease the cost of living for the poor and middle class but also enhance India’s appeal to investors, entrepreneurs, and global markets by simplifying the tax structure and making business more efficient.

“From tomorrow, the nation will celebrate GST Bachat Utsav. Your savings will increase, and you will be able to buy your favourite things. This reform will benefit every section of society,” the Prime Minister stated in his televised address.

Central to the reform is a new two-tier Goods and Services Tax (GST) rate system — of 5% and 18% — approved by the GST Council earlier this month. The new structure takes effect from September 22, coinciding with the first day of Navaratri.

Under GST 2.0:

-

99% of goods that were previously taxed at 12% will now be taxed at 5%.

-

90% of items earlier placed under the 28% slab will now fall under the 18% bracket.

-

A 40% compensation cess will continue to apply to luxury and sin goods such as tobacco, high-end vehicles, and aerated drinks.

Reflecting on the past, Modi criticised the pre-2014 tax regime as a convoluted system of levies that raised business costs and created cascading effects that ultimately hit ordinary citizens the hardest.

“For years, businesses and consumers alike were caught in a web of taxes and tolls. Companies bore daily struggles, and the increased cost of transporting goods from one city to another ultimately fell upon the poor and common citizens. It was essential to free the nation from this maze,” he remarked.

Modi called GST 2.0 a “double bonanza” for Indian households — lowering prices on essentials while increasing savings. He further stressed that the new system would bring uniformity across states, boosting cooperation and shared growth.

“These reforms will accelerate India’s growth story, simplify business, and ensure that every state becomes an equal partner in the journey of development,” the Prime Minister said.

Economists and industry leaders are watching closely as the new system is expected to reduce compliance burdens, promote consumption, and position India as a more predictable and investor-friendly economy.

With the festive season approaching, the government is positioning GST Bachat Utsav as not just a tax reform, but a symbolic shift towards a simplified, citizen-centric economic model — one that promises long-term benefits for both consumers and businesses.