Rons Bantwal

Mumbai, Sep 10: Model Bank, by expanding the reach of its digital services, is well prepared to achieve greater growth in the future. In the past financial year, the bank implemented several strategic measures to promote progressive business growth, ensure customer financial satisfaction, and maintain high service standards. Thus, Model Bank holds the distinction of offering rewarding financial services to its customers, said the bank’s Chairman, Albert W D’Souza.

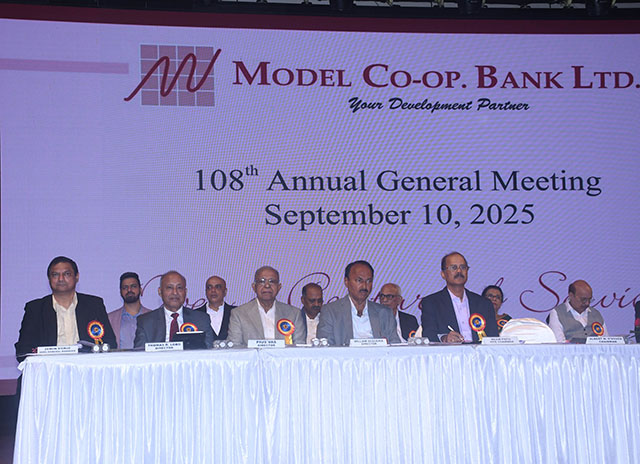

On Wednesday afternoon, at St Andrew’s Auditorium, Bandra (West), Model Co-operative Bank Ltd held its 108th Annual General Meeting. Addressing the gathering in his presidential speech, Albert D’Souza stated that the Bank continues to be classified as a Financially Sound and Well Managed (FSWM) Institution, consistently meeting all parameters laid down by the Reserve Bank of India.

The bank recorded a growth in deposits of Rs 24.06 crore, rising from Rs 1216.04 crore to Rs 1240.10 crore, and a growth in advances of Rs 29.77 crore, from Rs 605.37 crore to Rs 635.14 crore. The net NPA remained nil, and the Capital Adequacy Ratio stood at 15.82%, well above the prescribed benchmark. The net profit (after tax) stood at Rs 7.26 crore.

The bank provides most of the digital services such as mobile banking, internet statement view facility, UPI payment interface, tie-up for card swipe machines, contactless tap-ATM debit cards, RuPay ATM cum debit cards and platinum RuPay debit cards. 50% of the banks active customers are utilizing its range of digital services.

The bank is poised for further growth as it continues to expand its digital offerings. The bank also has authorised dealer category II license for full fledged money changing operations for foreign exchange as well as NRE accounts for our NRIs.

Presenting the annual report along with audited statements and the statutory audit report for the financial year ended 2025, Albert D’Souza expressed happiness at the bank’s performance. He said that once again, RBI’s audit classification has certified the bank with ‘A’ grade, and the Board has declared a 10% dividend for shareholders.

Seated on the dais were vice chairman Maxim I Pinto, directors William Sequeira, Vincent Mathias, CA. Paul Nazareth, Abraham Clement Lobo, Sanjay Shinde, Thomas D Lobo, Lawrence D’Souza, adv Pius Vaz, Gerald Cardoza, Ancy D’Souza, Hilary L Mendonca, adv Fiona M Nazareth, Asha S D’Souza, board members CA Elroy Rodrigues, Jude P Lobo, adv Sunne A Lobo, and general manager & CEO Osden A Fonseca and additional general manager Zenon D’Cruz.

The parish priest of St Andrew’s Church, Fr Nigel Barrett, inaugurated the AGM with blessings and wished for the all-round growth of the Bank.

Director Thomas D Lobo spoke with the govt providing an impetus to the cooperative movement "We need to evolve without losing our soul-our commitment to community-based, inclusive banking. We need to move forward with courage, clarity, and compassion. Together, we can not only overcome today's challenges but continue to build a bank that remains future-ready, member-focused, and professionally managed. On behalf of the board of directors, board of management, sr management and staff we extend our thanks to each one of you for your trust, support, and unwavering belief in our mission. Let us continue to walk this path-with prudence in our minds and progress in our hearts."

Former vice chairman Vincent Mathias said in handing over the bank to future generations, "We need to make some sacrifices. He added that it is through the hard work and farsightedness of the founders and former board of directors that the bank has grown to this level and we too must cultivate a spirit of dedication."

CEO Osden A Fonseca presented the audited financial statements, balance sheet, and profit and loss account of the concluded financial year and responded to the members’ queries.

Among the members who spoke were Patrick G Fernandes, Myra Pereira, John D’Souza, John Lobo, John Monteiro, Edwin Menda, Roshan Saldanha, Stanley Fernandes, Henry Lobo, Francis D’Souza, Stany D’Souza, Leo Machado, John Fernandes, Richard Prabhu, Gregory Dotti, Pascal Lobo, Celine D’Souza, Victor Britto, Aldous Almeida, Leslie D’Silva, Roshan Rodrigues and others, who appreciated the services and offered valuable suggestions, wishing success for the bank.

Assistant general managers Jude D’Silva, Ratnakar Shetty, Naresh Thakur, Henry Quadros and chief compliance officer Digambar Prabhu Tendolkar were also present.

Tributes were paid to members, customers, and well-wishers who passed away during the year. Osden Fonseca welcomed the gathering. Manager Roshni Monteiro compered the programme. Zenon D’Cruz proposed the vote of thanks. The AGM concluded with the National Anthem.