Daijiworld Media Network – New Delhi

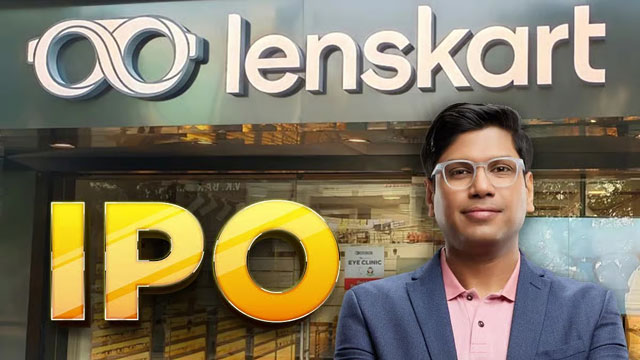

New Delhi, Oct 26: Lenskart Solutions, the Peyush Bansal-led eyewear company backed by global investors including SoftBank, ADIA, Temasek, and Kedaara Capital, is set to open its maiden public issue on October 31. The IPO will comprise a fresh issue of shares worth Rs 2,150 crore and an offer-for-sale of 12.75 crore equity shares by existing shareholders.

The IPO has already attracted notable investors, with DMart’s Radhakishan Damani investing Rs 90 crore ahead of the issue opening. Promoters and investors planning to offload shares include co-founder Peyush Bansal (over 2 crore shares), Amit Chaudhary and Sumeet Kapahi (28.7 lakh shares each), SoftBank’s SVF II Lightbulb (2.6 crore shares), Kedaara Capital, and Alpha Wave Ventures.

According to the Red Herring Prospectus (RHP), the fresh proceeds will be deployed mainly for lease and rent payments of company-owned, company-operated (CoCo) stores in India, with Rs 591 crore allocated for their management and sustenance. Rs 320 crore will go towards marketing and business promotion, Rs 276 crore for capital expenditure to set up new CoCo stores, and Rs 213 crore for technology and cloud infrastructure investments. Remaining funds will be used for general corporate purposes.

Lenskart’s revenue from operations grew to Rs 6,652 crore in fiscal 2025, up from Rs 5,428 crore in the previous year.

The IPO is being managed by Kotak Mahindra Capital Company, Morgan Stanley India, Avendus Capital, Citigroup Global Markets India, Axis Capital, and Intensive Fiscal Services, acting as book-running lead managers.

The public issue marks a significant milestone for Lenskart, consolidating its position as one of India’s leading eyewear brands while providing investors a chance to participate in its growth story.