Daijiworld Media Network - Mumbai

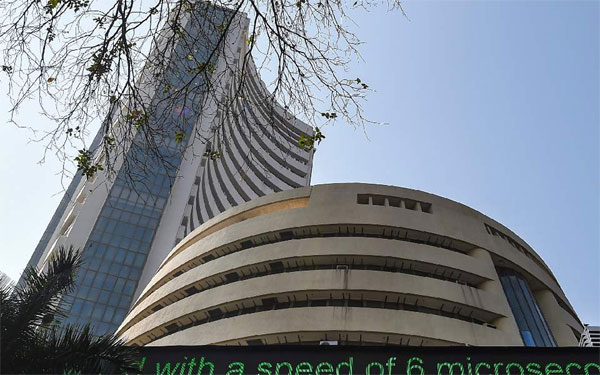

Mumbai, Jul 29: The Indian stock market bounced back into positive territory on Tuesday, snapping its recent losing streak, as key indices ended the session with solid gains led by renewed buying interest across sectors despite underwhelming Q1 earnings.

The BSE Sensex closed higher by 446.93 points, or 0.55%, settling at 81,337.95. The 30-share index opened on a weaker note at 80,620.25, but reversed course through the day, hitting an intraday high of 81,429.88 as heavyweight stocks lifted market sentiment.

The NSE Nifty 50 also posted a strong close, ending at 24,821.10, up by 140.20 points or 0.57%.

Market analysts attributed the rebound to selective buying amid muted corporate earnings and geopolitical uncertainty surrounding the ongoing US–India trade talks. While investor sentiment remains cautious ahead of key global events, the dip in early trade was viewed as a buying opportunity by institutional players.

Gainers on the day included L&T, Adani Ports, Tata Steel, Tata Motors, Maruti Suzuki, Bharti Airtel, HDFC Bank, Bajaj Finance, Asian Paints, and HCL Tech. On the flip side, TCS, Axis Bank, and Titan were among the top laggards.

Sectoral performance was broadly positive, with metal, pharma, and realty stocks leading the rally. However, IT, FMCG, and financials remained under pressure due to lackluster Q1 results.

Momentum extended to the broader markets as well:

• Nifty Next 50 rose 610 points (+0.91%)

• Nifty 100 gained 158 points

• Nifty Midcap 100 climbed 465 points (+0.81%)

• Nifty Smallcap 100 advanced 186.70 points (+1.01%)

Among sectoral indices:

• Nifty Bank rose 137 points

• Nifty Financial Services gained 85 points

• Nifty Auto surged 195 points

Meanwhile, the Indian rupee weakened, slipping 0.14 to close at 86.80 against the US dollar, marking a 0.16% decline. The depreciation came amid a stronger US dollar index, which hovered near the 99 mark, and ahead of key global economic data releases.

“With the August 1 US trade deal deadline approaching and high-impact US data—such as ADP employment, non-farm payrolls, unemployment rate, GDP, and the Fed’s policy announcement—due this week, forex markets are likely to witness heightened volatility,” said Jateen Trivedi, VP Research at LKP Securities. He projected the rupee to trade in the 86.45–87.25 range in the short term.

As markets brace for a data-heavy global calendar, analysts expect volatility to persist but say the current pullback signals resilience in domestic equities despite macro headwinds.