Fixed Deposits (FDs) have remained a popular investment choice due to their safety and guaranteed returns. In addition to being a long-term investment, FDs offer monthly interest payouts based on your preferences. Monthly payouts are beneficial for retired people, homemakers, or those needing funds to cover daily expenses.

They provide advantages such as predictable cash flow, minimal risk, and a stable way to supplement your income without uncertainty. With online tools like the FD calculator from Bajaj Markets, you can easily calculate your monthly interest payout in just a few clicks.

How to Start Earning Monthly Income from Fixed Deposits

FDs are available in two types – cumulative and non-cumulative. In cumulative FDs, the interest compounds and is paid at maturity, making them ideal for long-term wealth accumulation. Non-cumulative FDs, on the other hand, are more suitable for those seeking regular cash flow.

Non-cumulative FDs provide interest payouts at regular intervals such as monthly, quarterly, half-yearly, or annually. To receive monthly income, you need to select the monthly payout option when opening the FD. To start earning monthly income from an FD, visit your bank or financial institution.

Choose a non-cumulative FD with monthly interest payouts and invest a lump sum amount. Once this is completed, the interest will be credited to your account every month, ensuring a stable and reliable income stream.

Advantages of Monthly Interest Payout in Fixed Deposits

With benefits such as guaranteed returns, fixed income, and tax advantages, you can benefit from monthly payouts in an FD. Additionally, senior citizens enjoy extra perks. Here are the key benefits of opting for the FD interest monthly payout:

Periodic interest payments ensure a secure and consistent income stream. It helps manage monthly expenses like bills, food, or rent, maintaining a steady cash flow.

FDs come with flexible tenures, ranging from a few months to up to 10 years. You have the flexibility to select a tenure that aligns with your financial objectives.

Certain banks allow you to borrow against your FD without breaking it. This facility provides immediate liquidity in times of need while retaining the interest earned.

- Premature Withdrawal Facility

Premature withdrawal is possible, subject to a specified penalty, offering flexibility in emergencies or unexpected situations.

- Tax Benefits under Section 80C

Tax-saving FDs offer tax deductions up to Rs 1.5 Lakhs under Section 80C of the Income Tax Act, making them a valuable tool for saving taxes while earning interest.

- Benefits for Senior Citizen

Senior citizens typically receive an additional 0.25% to 0.50% interest. FDs with monthly payouts are an excellent choice for saving and generating retirement income.

At the time of investment, you can nominate a family member, ensuring a smooth transfer of funds in case of an unexpected event.

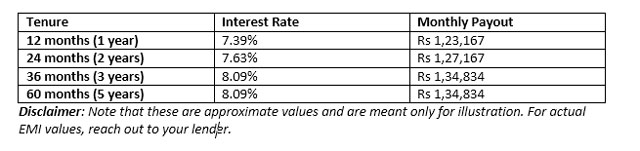

Example: Monthly Income from a Rs 2 Crore Fixed Deposit

In an FD investment, the monthly payout depends on the amount deposited, interest rate, and tenure. You can calculate the monthly payout of interest on an FD using this formula:

Monthly Interest = (P × R × T) / 100

P represents the initial deposit amount (principal), R is the annual interest rate, and T denotes the tenure of the FD in years. For monthly interest, T is considered as 1/12.

To better understand this, here is an example of the monthly interest on a Rs 2 Crore FD for several tenures and interest rates:

Choosing the Right Fixed Deposit for Monthly Income

Choosing the ideal fixed deposit (FD) involves more than focusing solely on the highest interest rate. To ensure monthly returns, you need to consider several critical factors before making an investment. Some of these factors are mentioned below:

- Define Your Investment Goals: Short-term FDs are ideal for immediate needs. Long-term FDs suit those seeking monthly income over an extended period.

- Consider Interest Rates: Focus on banks offering higher rates with monthly returns to maximise your earnings.

- Understand Compounding Frequency: Quarterly or monthly compounding yields higher returns than annual compounding.

- Review Tenure Flexibility: Choose FDs with flexible tenures instead of fixed durations.

- Assess Liquidity: Opt for shorter tenures if you may need funds sooner.

- Examine Premature Withdrawal Rules: Ensure early withdrawal is permitted and understand any penalties.

- Tax Implications: Interest earned is taxable. Choose FD terms based on your income tax bracket and 80C benefits.

- Evaluate Payout Frequency: Consider monthly interest payouts for a regular income stream.

- Verify Institutional Credibility: Invest in reputable, safe-rated banks or institutions.

- Look for Additional Features: Consider FDs with features like auto-renewal and overdraft options for convenience.

A stable monthly return from FDs offers a secure path to financial stability without risks. Non-cumulative FDs are well-suited for investors who need consistent income, such as retirees. By choosing the right bank, comparing interest rates, and selecting the appropriate payout frequency, you can optimise your returns.

Whether creating an income stream or saving for retirement, FDs play a significant role in ensuring steady returns. However, you need to verify the bank's reliability and the conditions for premature withdrawal before investing.